Maintaining a proper average collection period is the way to receive payments on time and keep them at your disposal. If you lose sight of that, the accounts receivables can get out of hand anytime, leading to funds scarcity. Finance professionals weigh multiple factors to determine the average performance of their company.

Predicting Cash Flow and Planning for Future Costs

You can also open the Calculate average accounts receivable section of the calculator to find its value. 🔎 Another average collection period interpretation is days’ sales in accounts receivable or the average collection period ratio. While timely follow-ups can improve your collection efforts, it’s essential to be professional and respectful when communicating with customers about their debts. Timely follow-ups on outstanding invoices can also enhance your average collection period. Regular reminders to customers about their due payments can prevent past-due accounts from extending too far beyond their due dates. The average collection period is a key indicator of the effectiveness of a company’s credit policy.

Grow Your Business with QuickBooks

Today’s B2B customers want digital payment options and the ability to schedule automatic payments. With traditional accounts receivable processes, there’s a significant communication gap between AR departments and their customers’ AP departments. When disputes occur, there is often a string of back and forth phone calls that draws out the process of coming to an agreement and getting paid. Collaborative AR automation software lets you communicate directly with your customers in a shared cloud-based portal, helping you resolve these problems efficiently. When there’s an issue with an invoice, your customer can leave a comment directly on the invoice or proceed with a short payment and specify why. Here are a few of the ways Versapay’s Collaborative AR automation software helps bring down your average collection period, improve cash flow, and boost working capital.

How to Transform Credit and Collection Operations for Proactive Receivables Recovery

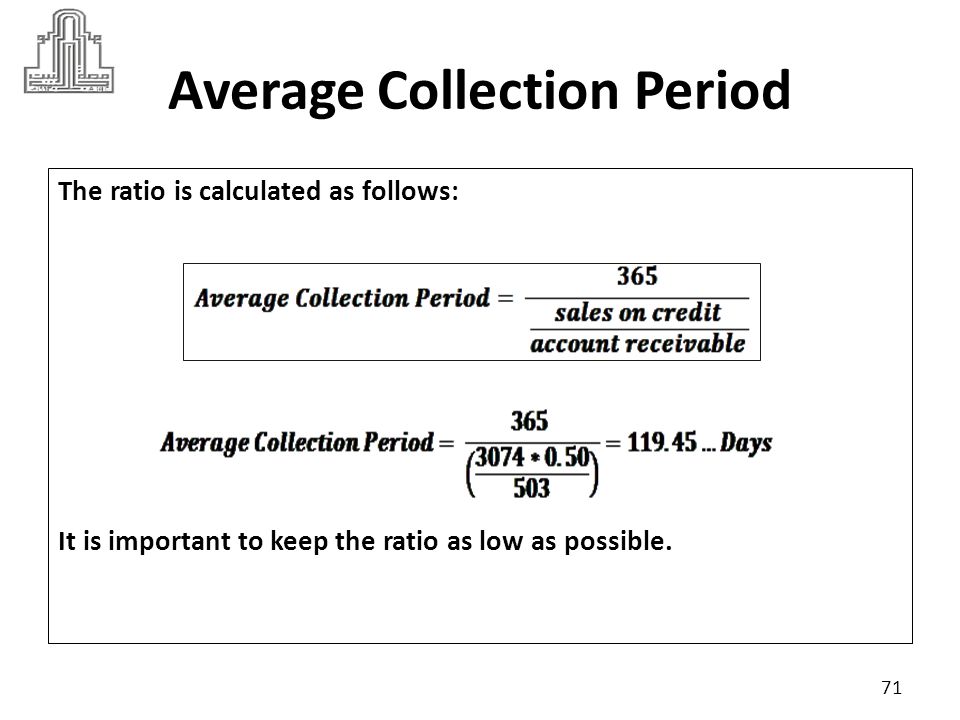

The time it typically takes to collect payment from your customers after you’ve delivered a product or services. The average collection period should be used in your financial model to accurately forecast how and when new customers will contribute to your cashflow. The time they require to collect the money back from the customer is known as the accounts receivable collection period. When customers take their steps to make payments, waiting for processing time to end is not good for both.

In most cases, a lower average collection period is generally better for business as it indicates faster cash turnover, which improves liquidity and reduces credit risk. However, if the shorter collection period is due to overly aggressive collection practices, it runs the risk of straining customer relationships, potentially leading to lost business. Comparing your organization’s industry benchmarks helps determine whether its average collection period is within a reasonable range. It’s important to note that some industries may have unique factors influencing their average collection periods. For example, the healthcare industry faces more complex payment processes due to insurance claims, discounted rates, or government reimbursements.

Importance of Average Collection Period in Accounting:

Make things easy by connecting with your customers using an intuitive, cloud-based collaborative payment portal that empowers them to pay when and how they want. A measurement of how well a business collects outstanding (unpaid) customer invoices. Instead, review your sample balance sheet and income statement for small business frequently and over a longer duration, such as a year. Every year, more than 40% of small businesses fail due to insufficient funds and cash flow problems. For example, customers who pay within 15 days from the purchase date can make use of a 10% discount.

On the contrary, a company with a long collection period might be offering more liberal credit terms or might not be enforcing its collections process strictly. This could indicate potential issues within the credit department that need addressing. In extreme cases, it might also signify a risky credit policy, possibly leading to increased bad debt expenses.

- Here are a few of the ways Versapay’s Collaborative AR automation software helps bring down your average collection period, improve cash flow, and boost working capital.

- For example, if a company has an ACP of 50 days but issues invoices with a 60-day due date, then the ACP is reasonable.

- This includes any discounts awarded to customers, product recalls or returns, or items re-issued under warranty.

- Average collection period can inform you of how effective—or ineffective—your accounts receivable management practices are.

- Slower collection times could result from clunky billing payment processes; or they might result from manual data entry errors or customers not being given adequate account transparency.

In turn, a shorter CCC signifies that the business can convert inventory into sales faster while collecting those receivables efficiently. A lower average collection period suggests that a company effectively manages its accounts receivable process and collects payments faster. However, it may also imply stricter credit terms which could deter potential customers seeking more lenient payment terms. The length of a company’s average collection period also indicates how severe its credit terms are. Strict terms may deter new consumers while excessively liberal terms may draw in clients who take advantage of such policies. This offers more depth into what other businesses are doing and how a business’s operations stack up.

Here, we’ll take a closer look at the average collection period, how to calculate it and more. Furthermore, a lengthier collection period reduces the availability of cash for investment opportunities, whether that’s expansion, R&D, or strategic moves to outperform competitors. Over time, missing these growth opportunities can negatively impact a firm’s market position and profitability. Join the 50,000 accounts receivable professionals already getting our insights, best practices, and stories every month.

Leave a Reply