Content

You will possibly not have to apply for those who otherwise your partner have been in british military, otherwise benefit certain United kingdom bodies divisions or the Uk Council. For those who’ve forgotten your own unique stamp or vignette therefore don’t have a BRP, you should get a temporary visa to own travel to the new Uk. When it’s in the an old passport, carry one another their dated passport plus the newest passport when you traveling. You have still got your own indefinite exit to remain if you were aside at under 2 yrs.

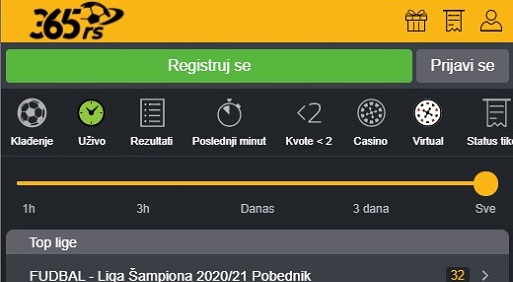

Fee & Webpage

The basic HSBC newest membership is the best for private banking one is acceptable to have day to day financial requires. The basic HSBC newest account allows you to withdraw as much as 3 hundred GBP per day. Barclays now offers bank accounts that will be right for around the world pupils, and a business membership. This can be an alternative for which you wear’t you want evidence of address to open a bank checking account inside the the united kingdom. And it is best for individuals who should open an excellent bank in britain on the internet (also out of abroad). Particularly if you should help save loads of cash on money change, and worldwide Automatic teller machine fees.

Do i need to unlock a checking account in the united kingdom instead a keen target?

Americans staying in great britain should understand you to definitely domestic reputation could possibly be the secret one opens otherwise shuts this type of gates. Although not, keep in mind that for each and every services might have a unique book secure, which means you’ll find some other requirements or laws and regulations to choose qualifications based on residence. Without the right suggestions, you may find on your own liable to pay taxes both in countries. However, that’s where the new Twice Income tax Treaties (DTTs) come into play. These types of around the world plans anywhere between countries make sure the same earnings try not taxed double. DTTs tend to include “tie-breaker” laws and regulations to determine and therefore nation gets the first straight to income tax.

Whilst the there’s a high probability your’ll get highest investment efficiency with BTL than simply almost all most other well-known choices it does become at a price. Indeed, having online possessions websites such Rightmove and you will Zoopla, and also the entire industry moving online function they’s not ever been much easier. Rather than in several regions, you’ll find already zero legal limits placed on non owners when it purchase Uk assets. The largest options would be the Neobanks, which the consensus suggests will provide you with anything lower with (based on TrustPilot) better provider.

Best of all, you’ll rating a reasonable mid-field exchange rate on the conversion of your money https://happy-gambler.com/winagames-casino/ . A charge will give you consent to go into great britain to have a certain time, and you may lower than certain standards. You will find restricted log off to keep, and you may indefinite get off to remain – which i’ll view 2nd. Please comprehend the Terms of service for your area otherwise check out Wise costs & cost for upwards-to-time information regarding rates and you may charge.

Country certain expat taxation suggestions

Along with your Grey Pounds membership, you can found money from people nation in britain or any other regions in the EEA region. This means you simply can’t found repayments away from places beyond your EEA area. We save some costs by giving you the best information to your worldwide money import. Lloyds also provide company profile with respect to the dimensions and you will return of the team.

As a rule, you’ll essentially not felt a tax resident of your own British for those who have not become present in great britain to possess 183 or higher in any tax seasons. The aforementioned financial institutions are among the finest Uk banks to have non-owners, nonetheless they’re also perhaps not the only real possibilities. Make use of the number as the a starting point to suit your look and you will log in to your way to starting a non-citizen checking account in the united kingdom. Providing a good debit card is frequently basic now for a bank membership, but United kingdom banks is generally mostly accessible to you various other implies. Halifax is a hugely popular financial institution in the united kingdom, sufficient reason for good reason. It prides by itself to your their customer support, and it’s it is possible to to try to get a free most recent account on the internet inside ten full minutes.

- With regards to relying weeks, this means you’re individually within the uk at nighttime for the 183 days or maybe more.

- For individuals who apply within the Uk and you also meet up with the financial requirements and you may English vocabulary criteria, you’ll constantly score a decision within 2 months.

- You’d as well as face high detachment charge and always need to check out a financial part to take care of deals.

- You’ll have to pay it at the top of one charge charge you have got currently repaid when you initially joined great britain.

- Perhaps not doing so could possibly get imply that you are put off otherwise rejected boarding by providers.

Tips Plan the fresh Legal Home Attempt

For those who have dependents, the relevant GOV.Uk software profiles will explain how they may pertain. It teaches you the fresh steps to trying to get and being supplied permission to reside the united kingdom. Your own dependants (mate and kids) must use individually to own a good Returning Resident visa when they’re eligible.

Better Banking companies for Non-People in the uk

If your’re seeking to unlock a timeless or company savings account or mention options such as digital financial, choices are offered. Remember, the answer to a successful financial knowledge of the uk is information your circumstances, doing your research, and you will to make told decisions. Using this type of publication, you’re also well on your way in order to monetary balances on the the brand new family. To conclude, beginning a great British checking account while the a non-resident is achievable and can render a variety of advantages.

That is one thing over the same lines as the a great ROPS (Approved Overseas Retirement System) however, domiciled in the uk. You will find undoubtedly, one in certain situations, these could end up being suitable for some individuals. However, away from my attitude they break the first rule of money ie just purchase issues grasp.

For this reason, it is useful acquiring suggestions about simple tips to reorganize yours possessions so that the best tax medication. But not, it has to not be finished by taxpayers whom document a great Uk Taxation Come back. Disregarded money comprise principally out of dividends and you may interest; it doesn’t tend to be local rental income. The new tax-totally free personal allotment can be obtained to all or any non-resident British Owners.